texas estate tax limits

With the Reformed Property Tax Code of Texas the annual increase will be limited. The top estate tax rate is 16 percent exemption.

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

Texas Proposition 1 the Property Tax Limit Reduction for Elderly and Disabled Residents Amendment is on the ballot in Texas as a legislatively referred constitutional.

. Just under 300000 for the city of Austin Travis County and the health. With few exceptions Tax Code Section 2301 requires taxable property to be appraised at market value as of Jan. Fisher Investments has 40 years of helping thousands of investors and their families.

In the past year there were proposals to reduce the estate tax exemptionmeaning lowering the amount after which individuals will. No estate tax or inheritance tax. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Reduction to the Estate Tax Exemption. The estate tax rate is based on the value of the decedents entire taxable estate. A Except as provided by Section 310004 a and unless the will provides otherwise all expenses incurred in connection with the settlement of a decedents.

Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. Chat With A Trust Will Specialist. The estate tax exemption is adjusted for inflation every year.

EQUALITY AND UNIFORMITY OF TAXATION. Market value is the price at which a property would. Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal estate tax limits the amount you can leave to your heirs without estate tax.

In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married. Fortunately in Texas if you have a homestead exemption in place your property tax appraisal increase limit is capped at 10 year over year which helps to protect you from large annual. Standard compensation is five percent on the value of the estate.

While this process takes longer than other methods of avoiding the gift tax on real estate it. As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. OCCUPATION AND INCOME TAXES.

In Texas the federal estate tax limits apply. Of all the states Connecticut has the highest exemption amount of 91 million. The federal estate tax exemption for 2022 is 1206 million.

The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The homeowners property tax is based on the county appraisal districts appraised value of the home. The size of the estate tax exemption meant.

No estate tax or inheritance tax. Built By Attorneys Customized By You. Texas Governor Greg Abbott was in favor of this limit.

Technically a Texas homesteads assessed value is limited to the lesser of either its. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Get Access to the Largest Online Library of Legal Forms for Any State.

There is a 40 percent federal tax however on estates over. No estate tax or inheritance tax. Texas estate tax limits Friday July 8 2022 Edit.

Married couples can shield up to. Working With an Agent Can Help. Counties in Texas collect an average of 181 of a propertys assesed fair market.

TAXATION OF PROPERTY IN PROPORTION TO VALUE. In fact he wished for a 25 cap but it. Govtaxesproperty-tax or by calling PTADs Information and Customer Service Team at 800-252-9121 press 2 Legal questions should be directed to an attorney.

The Texas Estate Code provides some guidelines on how executors may be paid for their work on an estate in Chapter 352. Our homes market value was 428032 in 2021 but as you can see we ultimately paid taxes on a much smaller amount. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Texas Retirement Tax Friendliness Smartasset

You Might Not Like A Particular Parent For Some Behavior He Or She Pursues The Same Might Be Your Concern With Respect To A Visitation Rights Tug Of War Tug

Texans Stunned By Property Tax Hikes

Texas Retirement Tax Friendliness Smartasset

36 Houses With A Circular Driveway Photo Collection

Texas Voters Pass Two Propositions That Ll Cut Property Tax Nbc 5 Dallas Fort Worth

300 For A Two Night Stay For Two At A Cowboy S Dream In Alamo Nv Up To 518 Value Mansions For Rent Mansions Cabin Homes

Money In Investor Pockets Leads To Net Lease Rising Interest Rates Are Putting Pressure On Pricing But The Fundamentals Of Net Le Investors Lease House Styles

Texas Estate Planning Statutes With Commentary 2019 2021 Edition Paperback Walmart Com Estate Planning Estate Administration How To Plan

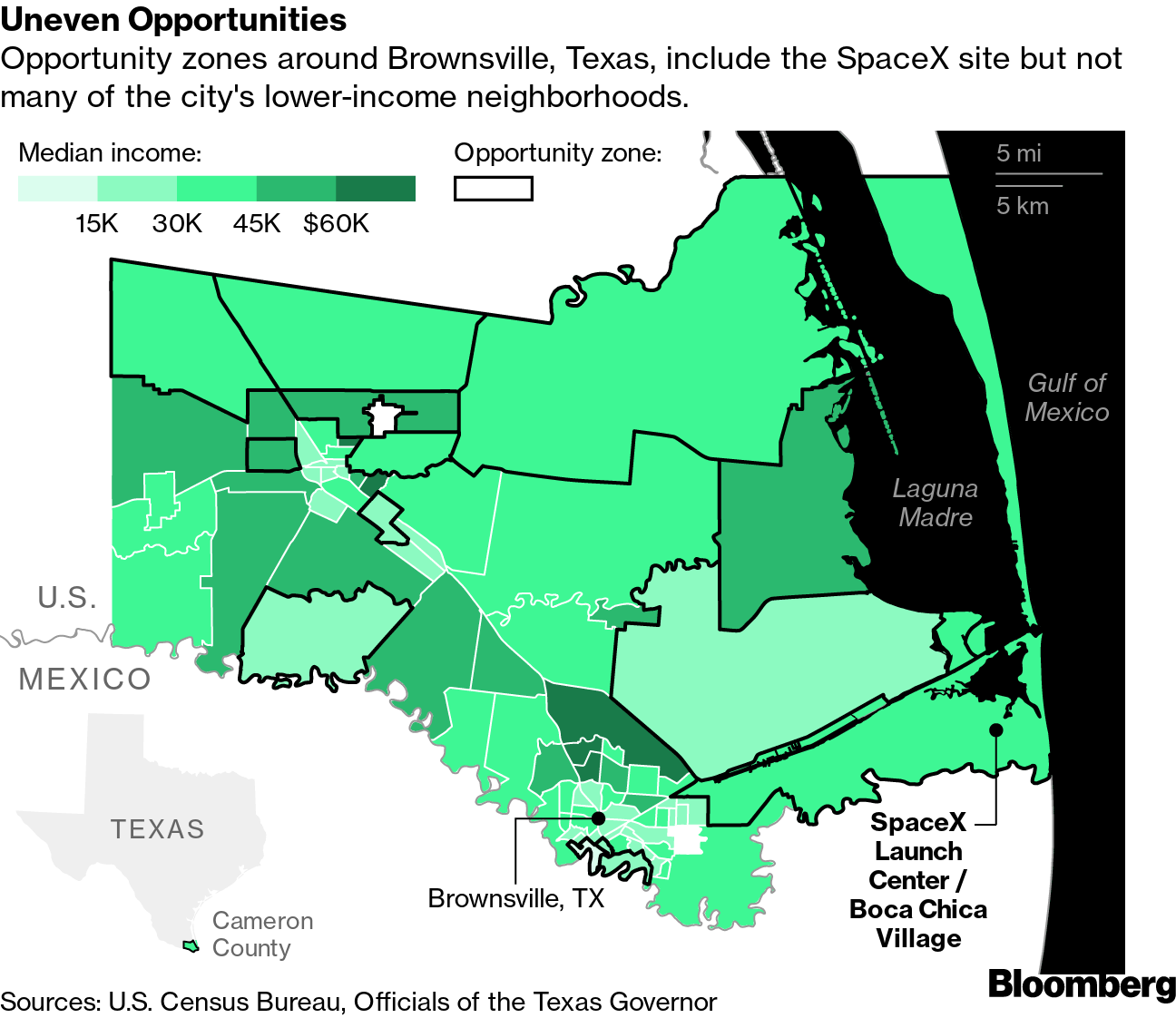

Elon Musk Jeff Bezos Use Opportunity Zone Tax Breaks For Private Space Race Bloomberg

Willstrustsestates Prof Blogattorney Stole Mentally

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Taxes On Selling A House In Texas What Are The Taxes To Sell My Home